How tenants can make the most of office trends

Contents

2. The office remains the productivity powerhouse

3. Businesses are on the move

4. Tenants are flocking to quality

5. Older stock is being withdrawn

6. You may need more space than you think

7. It's a tale of many cities

8. Now is crunch time for commercial tenants

Introduction

Businesses may be returning to the office after the great work-from-home experiment, but demand for office space has not yet fully rebounded. From an occupier’s perspective, now is the prime time to take advantage of the commercial real estate market.

But before you start a new conversation or strike a new deal with your landlord, Investa’s Group Executive Michael Cook has a few insights to share.

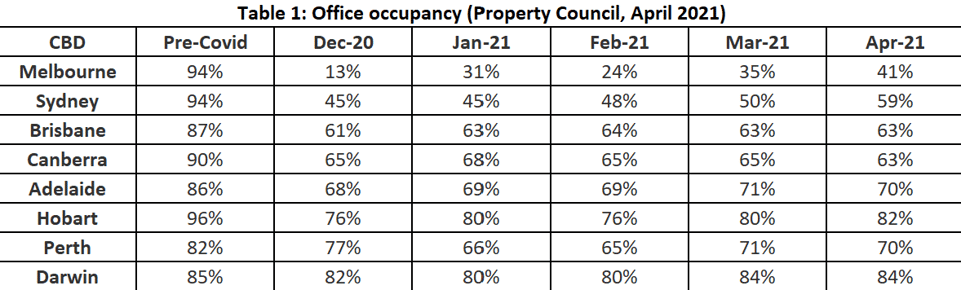

The Property Council of Australia’s April office occupancy survey – which measures the percentage of workers sitting at their office desks – has revealed a big step up in activity in our CBDs.

Some smaller office markets, like Darwin and Hobart, are back to pre-Covid levels. While our two biggest CBDs of Sydney and Melbourne – which together represent around 15% of our workforce – have some way to go, the signs are encouraging.

“Office buildings are never 100% occupied,” Cook says. “People may be absent because they are sick or caring for loved ones, they may be on annual leave, long service leave or parental leave. They may be out of the office making sales calls or working from a client’s premises. They could be attending a conference or could be overseas or interstate.”

Investa has empirical evidence to prove this. “We examined turnstile data to determine average occupancy levels over a four-year period. We found that, after excluding weekends and public holidays, the average peak daily occupancy was less than 75%. So, if the Property Council is saying that our major CBDs, except Melbourne, are at 60% or better, then we are close to returning to pre-Covid occupancy levels.”

The future of work may have arrived, and flexibility may be here to stay, but Cook says “beware of the unexpected human costs”.

One recent survey from Microsoft found 54% of employees feel overworked when working from home, and 39% feel exhausted. Microsoft says the “digital intensity” of the workday has increased. An eyewatering 40.6 billion more emails were delivered by Microsoft in February 2021 than in February 2020, for instance.

“I, for one, couldn’t wait to get back to the office so I could connect with my colleagues face-to-face and rebuild that division between work and home,” Cook says.

Reimagining our economic powerhouses, a report published by EY and the Property Council in March, found young people are the most enthusiastic about returning to their office, and Cook is not surprised.

Young people, those new to the workforce, or those starting new jobs learn “on the job” from their managers and peers, Cook adds.

“When connection is remote, there are no chance encounters, no hallway conversations or small talk over coffee. You can’t mentor people effectively over Zoom and it’s much harder to network and build meaningful relationships. Is it any wonder productivity was smashed during Covid?”

Many of the leaders of Australia’s biggest businesses agree. Qantas CEO Alan Joyce, who oversees 30,000 employees, has said “big companies cannot be successful if the whole workforce is working remotely most of the time”. While Alberton Calderon, CEO of mining multinational Orica, with 12,000 employees in Australia, has said publicly that “running a big company by Zoom is inefficient”.

“Working from home was good for JB HiFi and Bunnings and streaming services like Netflix and Stan,” Cook adds. “But if you want to get promoted or paid, you should head back to the office. If your job can be done from home, it can be done in Mumbai or Manila for a fraction of the cost.”

Leasing enquiries have surged over the last few months and agents are “run off their feet,” Cook says. The end of JobKeeper forced a lot of small-to-medium enterprises “back to business – and we noticed a bump in enquiries almost immediately”.

Real estate giant JLL says overall leasing interest in February was double last year’s level, growing 60% year-on-year. Space of 1,000 sqm or above is being keenly sought and those downsizing are only doing so to the tune of 10 to 15%.

CBRE’s most recent barometer of sublease space – that is, space that a tenant leases to a third party – found the availability of sublease space nationally fell by 2% in the first quarter of 2021. “This is a good sign that office markets are bouncing back,” Cook says.

Tenants are flocking to quality

The flight to quality is a trend often seen during downturns, and the Covid-19 crisis has proved true to form. Commercial real estate agents have tracked a “flight to quality” across all Australian markets, especially in Sydney and Melbourne.

According to CBRE, office vacancy rates for premium buildings in Sydney and Melbourne now stand at 8.5% and 11.3%, respectively. By 2024 prime vacancy rates in each city will be about 8%.

“Poorer quality secondary stock will either be reinvented or redeveloped – and that’s good for the ongoing renewal of our cities. The flight to quality keeps a city alive,” Cook notes. Investa’s two super premium assets in Sydney, Deutsche Bank Place and 60 Martin Place, are both full and have posted record rents since the beginning of 2021.

Older stock is being withdrawn

The Property Council’s Office Market Report for the six-month period to January 2021 shows that office vacancy rose from 9.6% to 11.7% – its highest level since January 1997. But hidden behind this headline figure is the new supply, which was responsible for three quarters of the impact.

In May, the NSW Government announced it would acquire 13 commercial buildings in Sydney’s CBD as part of the construction of two new Sydney Metro West stations. This will remove around 50,000 sqm of mostly B-grade office and strata space from the market, while enhancing transport networks and uplifting the entire Sydney CBD.

Cook says this is good for the market, as tenants leaving these buildings will be on the hunt for alternatives. “More than 60,000 sqm of space was withdrawn in 2017 for the current Sydney Metro projects – and that sent the market into a spin as tenants scrambled for space. “There are also at least three office buildings in the southern CBD totalling more than 80,000 sqm which are likely to be withdrawn within the next two-to-four years.

“When the top end of town is full, and B-grade space is being withdrawn, the remaining B-grade space must be upgraded to appeal. This puts further upward pressure on rental levels in A Grade and Premium stock.”

You may need more space than you think

Investa’s Head of Research, David Cannington, has run the numbers on a range of leading indicators. He’s found that, if the working from home advocates are correct, demand for commercial offices will fall by about 5%.

“That sort of reduction in space is just noise,” Cook says. He points to one 2013 study from Sydney University which found the smaller the office, the less satisfied people were with their space.

“After more than a year of working from home, people’s tolerance for ambient noise has been eroded. We’ll need more Zoom rooms, quiet zones and collaboration spaces. Put social distancing requirements into the picture and the space that once handled four people can only handle three. The required additional social distancing space will negate the reduction in space from working from home.”

It’s a tale of many cities

Every market tells a different story, Cook adds. While Sydney is recovering with a rocket, Melbourne’s recovery will be more of a slow burn, following the “double whammy” of two lockdowns that “put a dent in that city’s confidence”.

In Perth “where there was minimal impact from the global financial crisis and where the Covid crisis has virtually passed them by”, record iron ore prices are buoying the local economy. While the commercial office market is still struggling with oversupply, Cook says exploration activity – which recently hit a five-year high – has re-emerged as a key white collar job driver.

Brisbane’s office market remains soft with the coal, tourism and education sectors all experiencing various negative effects of Covid. “But there is still life in Brisbane’s CBD and deals are being struck. It will recover.

“Covid has proven that uncertainty erodes confidence, and it is difficult for people to make decisions. But now that the vaccine roll-out is in full swing, certainty and confidence are returning.”

Now is crunch time for commercial tenants

Over the last year, building owners have had to offer more flexible leases, some with shorter terms. Options have been supplanted with one or two-year leases to enable tenants to determine what their businesses will look like in a post-Covid recovery. Incentives have become a permanent part of the commercial leasing landscape in many cases, making impossible deals possible.

“The Covid hangover has manifested itself in shorter lease terms and higher incentives, but don’t expect this to last for long,” he says pointing to Investa’s 60 Martin Place, which is currently fully tenanted. “Most recent deals have been at sub-25% incentives and some at record face rents.”

Cook’s message?

“Make hay now while the sun shines – because incentives at current levels will not be a feature in an economy that is back in full swing.”